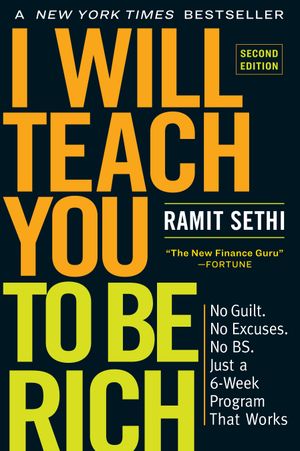

As seen on the new NETFLIX series! The groundbreaking NEW YORK TIMES and WALL STREET JOURNAL BESTSELLER that taught a generation how to earn more, save more, and live a rich life—now in a revised 2nd edition.

Buy as many lattes as you want. Choose the right accounts and investments so your money grows for you—automatically. Best of all, spend guilt-free on the things you love.

Personal finance expert Ramit Sethi has been called a “wealth wizard” by Forbes and the “new guru on the block” by Fortune . Now he’s updated and expanded his modern money classic for a new age, delivering a simple, powerful, no-BS 6-week program that just works.

I Will Teach You to Be Rich will show

• How to crush your debt and student loans faster than you thought possible

• How to set up no-fee, high-interest bank accounts that won’t gouge you for every penny

• How Ramit automates his finances so his money goes exactly where he wants it to—and how you can do it too

• How to talk your way out of late fees (with word-for-word scripts)

• How to save hundreds or even thousands per month (and still buy what you love)

• A set-it-and-forget-it investment strategy that’s dead simple and beats financial advisors at their own game

• How to handle buying a car or a house, paying for a wedding, having kids, and other big expenses—stress free

• The exact words to use to negotiate a big raise at work

Plus, this 10th anniversary edition features over 80 new pages,

• New tools

• New insights on money and psychology

• Amazing stories of how previous readers used the book to create their rich lives

Master your money—and then get on with your life.